Commentary series: Covid-19 and climate change

By Josh Burke

27 April 2020

The UK is beginning to experience the societal and economic impacts of climate change. Poor people and communities are the most vulnerable to these impacts and this is being amplified by Covid-19.

It is widely recognised that it is unfair for the costs of climate change to be borne entirely by those who are affected by the impacts, rather than those who are causing the impacts through greenhouse gas emissions. Economists therefore advocate putting a price on emissions through a tax or emissions trading. This is consistent with the ‘polluter pays’ principle and ensures that low-emissions goods and services (such as offshore wind in the Humber and electric vehicle manufacturing in Birmingham) can compete on a level playing field without their high-carbon rivals enjoying the advantage of an implicit subsidy.

Under a net-zero target, a more emphatic use of carbon pricing is necessary to induce emissions reductions in an efficient way. However, carbon pricing is often hard to implement as it is more transparent than other policies about its economic winners and losers. Consumers are extremely sensitive to changes in the prices of vital provisions such as energy, transport and food, as recent protests in Chile, France and Ecuador demonstrate. Thus, carbon prices are often too low to be truly effective, many sectors are not covered, and in those that are, significant exemptions dilute policy efficacy

While many climate policies, including carbon pricing, have the potential to be regressive – that is, their costs are borne disproportionately by poorer people – it is possible to mitigate such impacts on households, to ensure fairness and political acceptability. Her Majesty’s Treasury is currently undertaking a review of how the transition to net-zero will be funded and where the costs will fall. That review presents an opportunity to ensure that UK carbon policy, and policy more generally, is underpinned by principles of equity and fairness. Doing so will help to avoid resistance and backlash from those who might otherwise lose out

Variations by geographical location

The distributional impact of carbon tax policy has a place-based element. Below we examine how income groups are distributed across the UK and how the impact of the carbon tax varies geographically under a carbon tax of £50 per tonne of carbon dioxide in 2020, rising to £75 in 2030.

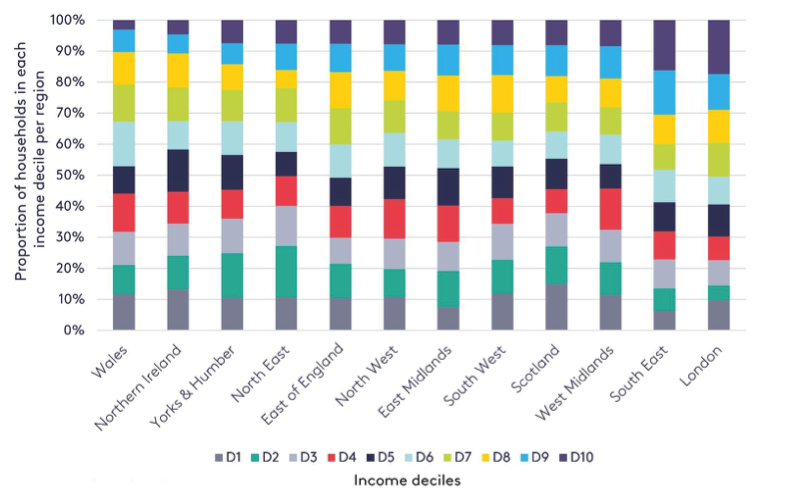

Figure 1 illustrates that London and the South East are the regions with the largest proportions of income deciles 9 and 10 households – the wealthiest. Wales has the smallest proportion of decile 10 households, followed by Northern Ireland and Yorkshire and the Humber. In terms of low-income households, Scotland has the largest proportion of decile 1 households, followed by Northern Ireland.

Figure 1: Distribution of income within UK regions

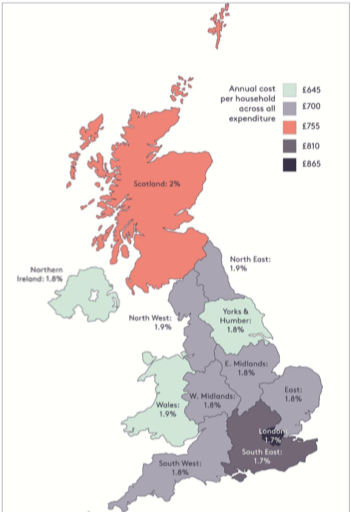

Figure 2 shows which regions experience the greatest impact of the carbon tax, both in absolute and relative terms, and compares this with the location of income deciles. It shows some interesting results, with the difference between the area with the biggest impact (London) and the smallest impact (Northern Ireland) being £220 per household per year.

Figure 2: Impacts of scenario 2 carbon tax policy across UK regions in 2030: £ per household per year across all expenditure and % increase as a proportion of income

The greatest impact of the tax, in absolute terms, per household is on households in London, followed by the South East and then Scotland. For the first two regions this is expected, as they have the largest proportion of high-income decile households, which leads to more consumption and thus a higher tax. In contrast, Scotland has the largest proportion of low-income households. This should mean a low tax on an income basis but because the climate in Scotland is colder and the country is more rural overall than other parts of the UK, more heating and transport is used and so the tax is high.

Distributional analysis is the term used to describe the process by which the effect of a policy or event may have on the different demographics within society. Where the analysis focuses on the effect on low and high-income households, this is known as vertical effects. In contrast, the ways in which households that are similar in income otherwise differ can be described as ‘horizontal inequities’ – they include number of occupants, location and building characteristics. When assessing the impact of any policy, government must also consider these ‘horizontal’ effects, which hitherto have been largely neglected.

Examining the impacts in absolute terms highlights that horizontal factors other than income distribution, such as household type (e.g. off- grid rural households, fuel-poor terraced houses) and geography, are important in determining the tax impacts. The vertical impacts of the carbon tax are illustrated by the percentage of income impact, which ranges from 1.7 per cent to 2 per cent. Although in absolute terms the carbon tax has the biggest impact in London and the South East, as a percentage of income it has the smallest impact in those regions relative to other regions. In relative terms the impact of the carbon tax is greatest in Scotland; given that Scotland has the highest proportion of lowest income households, this is an expected outcome.

The UK’s transition to net-zero greenhouse gas emissions must be distributionally fair

The UK’s transition to net-zero greenhouse gas emissions must be distributionally fair, and policies must be designed to mitigate undesirable distributional impacts. Understanding the geographic spread of carbon tax impacts is vitally important to identify where any adverse impacts might occur. To mitigate this impact, conventional fiscal thinking that sees all revenue treated as general tax must change to ensure that the impacts of carbon pricing are distributed fairly and that the policy becomes more politically and socially acceptable. Carbon tax revenues should be explicitly used to correct undesirable distributional outcomes.

The Government response to Covid 19 has ripped up long held economic orthodoxies. Ideas that were anathema to Treasury thinking only weeks ago, such as hypothecating tax revenue, should now be seen as a sane policy response to both the Covid emergency and the climate emergency we now face.

Josh Burke is a Policy Fellow at the LSE Grantham Research Institute on Climate Change and the Environment where he focuses on economic policy levers to drive the UK’s transition to Net Zero

Image: Dom J, Pexels